A newly introduced Ending Platform Monopolies Act in the U.S House aims to “eliminate the conflicts of interest that arise from dominant online platforms’ concurrent ownership or control of an online platform and certain other businesses.” People are concerned especially about those big platforms since their search guidance and algorithmic recommendations seem to have big impact on consumer’s behavior online. In this webinar, Dr. Musolff will propose a novel structural model of platform intermediation power combined with rich data about sales and recommendations on Amazon Marketplace.

Dr. Musolff started the presentation with the setting of this project. He pointed out two elements that make Amazon a good subject for studying the effect of platform-guided search and recommendation. First, although Amazon started as a reseller platform, it has evolved into a marketplace in which around 60% of its sales created by co-listed third-party sellers. Amazon is also selling its own private-label brands in its marketplace imposing additional competition pressure on third-party sellers. Second, the Buybox button on Amazon provides a unique environment (dubbed as econometrician’s paradise by the speaker). Buybox is a product recommendation system developed by Amazon. When a consumer searches, for examples, a water bottle, a consumer usually sees a box on the web page with an option to immediately buy the product. A key part of the Buybox system is that a consumer can see the products with the same observable characteristics sold by different retailers if she clicks one more link below the “Buy Now” button. Since the recommended product has no difference in observable characterizes with non-recommended products, it is almost a prefect setting to test the impact of recommendation on consumer’s purchase decision.

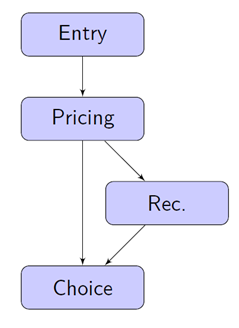

The model consists of three actors: consumers, sellers, and the platform. It is assumed that certain fraction of the consumers is naïve meaning that those consumers either buy the recommended products or do not buy. The other group of consumers are sophisticated and they consider all the products on the search page. The recommendation system is governed by the platform. It considers various factors such as price, delivery time, the number of feedbacks, whether the product is fulfilled by Amazon or not etc. and recommends one product to consumers out of multiple observably same products. Lastly, sellers determine product price and whether to enter the platform or not. Sellers already know that their decisions on price would impact the platform’s recommendation result.

After introducing the model, Dr. Musolff presented the results from two regression analyses. The first one analyzes the factors affecting platform’s recommendation outcomes. The result shows that price, shipping time, and whether the seller is Amazon or not play important roles in determining the recommendation result. However, this result alone does not necessarily imply for bias in Amazon’s recommendation algorithm. Amazon may recommend Amazon products just because consumers prefer Amazon products. The result of next regression is aligned with this view. It shows that consumers have strong preference for Amazon’s products. Also, around 26% of the consumers are estimated to be naïve, which means that they only buy the products recommended by Amazon.

Built upon all these model ingredients, Dr. Musolff introduced interesting results from two counterfactual analysis. The first one assumes an imaginary world where Amazon does not put any weight on if the product is made by Amazon in its recommendation algorithm. Then, Dr. Musolff compares the welfare of this imaginary world to the real world where Amazon puts positive weight on its own products in recommendation. He showed that Amazon’s self-preferencing increases consumer welfare, especially from naïve consumers. This is because consumers prefer Amazon products. The effect does not disappear even after the model allows the sellers to adjust their pricing and entry decisions.

The second analysis estimates the value of Amazon’s Buybox recommendation system. To measure the value, Dr. Musulff this time constructs another imaginary world where Amazon randomly recommends a product to a consumer out of the product pool. He found that Amazon’s recommendation system increases the welfare of the platform and sellers as well as consumers. Consumers, especially naïve ones, are better off because they are recommended Amazon products. As the volume of transaction increases, it improves both the seller welfare and platform fees. Consumer welfare increases even more when the sellers can adjust their prices. As sellers competitively decrease prices to get recommended by the platform, it lowers an equilibrium product prices, and consequently increases consumers welfare. However, on the other hand, the decreases in product price lowers sellers’ profits and the amount of fess that the platform can collect from the sellers. The story goes further by allowing the sellers to adjust their entry decisions. Heavy competition generated by recommendation system lowers the expected profit of sellers and decreases the number of new entrants. Consequently, consumers welfare decreases even more due to the lowered number of seller entry.

Dr. Musolff’s paper tackles one of the most important and interesting questions about platform: what is the effect of platform guided search and recommendation on welfare? He showed that the platform intermediation power exists and that its impact on welfare is dependent upon strategic behavior of sellers (price and entry). Lastly, self-preference can be welfare-enhancing if consumers preference platform’s products.

If you would like to give a presentation in a future webinar, contact our Senior Economist Dr. Wen Chen (wen.chen@luohanacademy.com). For other inquiries, please contact: events@luohanacademy.com.